King County Assessor

Welcome to our webpage! Great customer service is job 1 for us and we hope this site will help you with issues regarding property values, and the tax relief programs we administer.

Below you will find a link to destroyed property tax relief information which you can use if your property suffered damage during the recent windstorm, and links allowing you to apply for a property tax exemption if you are a senior, a disabled veteran, or a disabled person, if you meet the program requirements.

You can also find information on your property’s value, details and data on our property tax system, how to appeal your property value, and information on our office.

Please don’t ever hesitate to contact us. We are here to help!

John Wilson, King County Assessor

|

Property tax relief is available for windstorm damage |

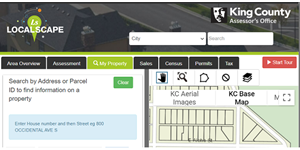

View valuations, property characteristics, |

|

|

|

|

Explorer King County! |

|

|

|

|

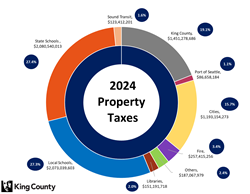

Where do my property tax dollars go? |

NEW Housing Availability Dashboard Real-time, data-driven, |

|

|

|

Translate

Translate